Japan’s new gender pay gap disclosure rules are set to be strengthened; requiring many Japanese firms to report new information by June next year.

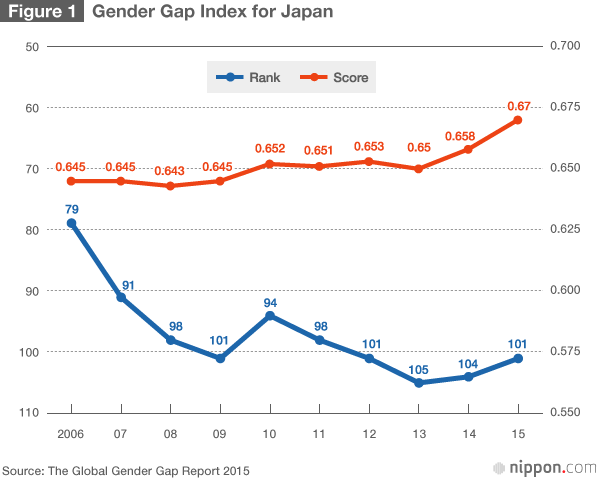

The move may improve diversity in a country that has long trailed behind global counterparts in gender equality.

The difference in wages reflects a more fundamental gap in the amount of decision-making power women have compared to just a lag in titles, points out Ayako Fujita, Japan Chief Economist at JPMorgan Securities Japan.

“Disclosing it leads to a truer way of helping women to take a more active role in business,” said Fujita; who contributed to a recent JPMorgan report that focused on women’s professional advancement. “Nothing will change if we just let things be the market has; to put pressure on companies to change by requiring disclosure.”

What is the disclosure?

The pay gap isn’t the only new mandatory disclosure under Prime Minister Fumio Kishida’s “new capitalism” policy. From the next fiscal year onward companies’ securities reports must also include the ratio of women in management positions; and the percentage of male employees taking childcare leave.

Japan’s gender pay gap is the largest among Group of Seven nations. Women’s share of labor income in Japan was just 28.2% in 2020; far below the group’s other six countries according to the latest World Inequality Report.

“Japan’s gender pay gap won’t completely change in a few years,” said Fujita. That’s why fast responses are needed from the government; to get Japan to shift away from existing structures within firms and work environments that lack diversity, she said. “Increasing diversity also leads to innovation,” the economist said.

While efforts to increase the number of female employees have made some progress; “there hasn’t been much of a discussion of how those people should change firms,” said Fujita.

Japan has held a goal to get 30% of managerial positions held by women since 2003, but the number of women on boards hasn’t increased much so far. The percentage of women on the boards of listed firms has risen more than fivefold in the past decade; but still remains low, according to the Cabinet Office. The percentage of women in managerial positions also remains at 9.4%, according to the latest survey from Teikoku Databank.

While the number of female board members has climbed, “it hasn’t got to the level where diversified viewpoints are meaningfully reflected in managerial decisions,” said Rie Nishihara, Head of Japan Equity Strategy of JPMorgan, who also contributed to the report. In order for that to happen, the percentage of women on boards needs to rise to 30%, she said.

Results that we expect

“We have hopes that the 30% leadership goal will be reached by 2030,” said Rina Bando; senior manager at consulting firm Mercer Japan, who last month authored a report on gender pay disclosures. “Although changes do not happen easily in Japan, we are definitely seeing shifts in awareness in the past few years, especially as Japan follows the footsteps of the U.S. and Europe in promoting diversity.”

Japan’s number of female board members lags far behind global peers. In June, the European Union agreed to require listed firms to have a share of 40% of the underrepresented gender among non-executive directors and 33% among all directors by mid-2026.

If diverse opinions start being reflected in management decisions, that could also impact stock performance. Nishihara said that when the market is in a downtrend, shares of firms that have a diverse management team may be held on to more, and could reduce downward pressure on stocks.

A high number of women on boards appears to reduce stock price volatility across most regions; Bloomberg Intelligence ESG strategist Shaheen Contractor also wrote in a report. “The strategy may reduce risk and offer downside protection,” she said.

Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank said: “Profit comes from discovering things and services that can be helpful to the public. When thinking about those new value-added services, people might miss out on potential opportunities if they do not have a diversified perspective.”

Women held three fewer seats on the boards of companies in the 225-issue Nikkei stock index in the third quarter from the previous three-month period, according to data compiled by Bloomberg. The average number of female directors was unchanged at 1.5, out of an average board size of 10.4.

Source: Japan Times